Growing up in Florida, Dr. David Marlett witnessed firsthand the devastating impact of hurricanes on communities and the economy. Managing catastrophic risk now has become his teaching and research niche.

Marlett is managing director of the Brantley Risk and Insurance Center in Appalachian State University’s Walker College of Business. He is among the many Appalachian faculty who create life-changing experiences in the classroom and beyond.

“Effective risk management and a healthy insurance market lead to a more resilient society and faster recovery from a disaster. If we do our jobs well, it will help individuals live more productive and happy lives.”

Dr. David Marlett, managing director of the Brantley Risk and Insurance Center

- What excites you about risk management and insurance?

-

There is a lot of uncertainty in our society at this time with impact of climate change, workplace violence, harassment cases and cyber risk, just to name a few.

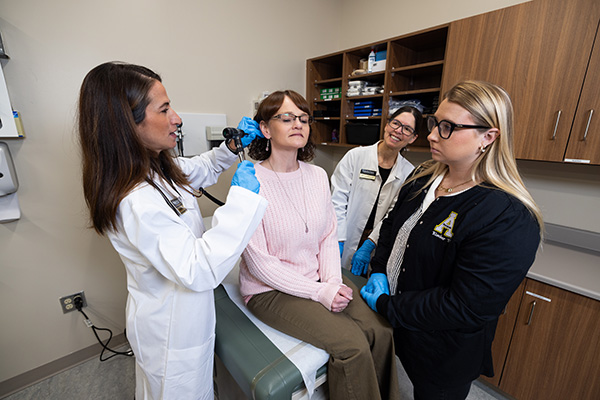

At the end of the day, risk management is about protecting people and improving their quality of life. Effective risk management and a healthy insurance market lead to a more resilient society and faster recovery from a disaster. If we do our jobs well, it will help individuals live more productive and happy lives. It will also help businesses and communities be more sustainable and able to avoid and withstand adverse events.

- Why did you choose to come to Appalachian to teach?

-

I wanted to teach at a traditional undergraduate institute that focuses on the student. My wife and I also wanted to raise our kids in a college town that was beautiful, safe and vibrant.

- What is your research specialty and how does it fit into and/or strengthen your teaching?

-

Most of my research has focused on government programs designed to manage catastrophic risk. I grew up in Florida and lived there for 30 years. I saw firsthand the aftermath of Hurricane Andrew and the devastating impact on the communities and economy. When the residential property insurance market struggled after Andrew, the impact was felt by lenders, builders, realtors, developers and others. It made a big impact on me, and that experience led to my dissertation on the topic in graduate school.

Nearly all the Gulf Coast and Atlantic states have high-risk insurance programs designed by the state governments, and I’ve had the opportunity to work closely with the leadership of many of those organizations. Several years ago, I was appointed to a Legislative Task Force on Hurricane Issues in North Carolina and we provided a comprehensive report to the General Assembly. Nearly all our recommendations were adopted into law and resulted in meaningful improvements for residents in North Carolina.

Given our recent series of significant hurricane hits, the insurance sector and the state high-risk program all performed very well. I share this experience in the classroom and invite contacts to visit the classes. I teach a class on international insurance markets each spring that heavily focuses on catastrophe issues. When we travel to London and Bermuda, hurricane and flood risk are two of the major topics.

- What do you hope students take away from your classes?

-

On a personal level, it improves the level of financial literacy. After taking my Principles of Risk Management class, students will be more educated consumers and voters. Following completion of upper-level courses, they are highly marketable and ready for full-time employment.

- Why should a student interested in risk and insurance management choose Appalachian?

-

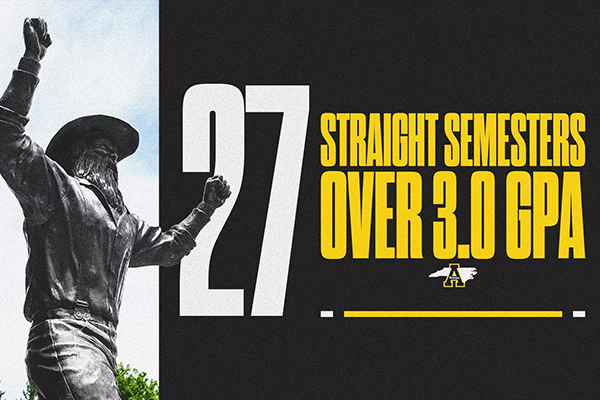

The risk management and insurance program (RMI) at Appalachian is recognized as one of the top in the nation. We are one of the largest, with over 200 majors, but also one of the most respected by professionals. The Walker College of Business career fair attracts recruiters from across the nation targeting RMI majors, and we typically have the largest number of any major in the college.

The level of faculty and staff engagement makes the program special. We work closely with the students on and off campus.

We have recently received recognition as a Global Center of Insurance Excellence (GCIE). In addition, we were recognized as a top 10 RMI program in the U.S. by Business Insurance magazine rankings and named a “Strong Performer” in A.M. Best magazine (February 2018).

Learn more about Dr. David Marlett

What do you think?

Share your feedback on this story.

About the Brantley Risk and Insurance Center

The Brantley Risk and Insurance Center in Appalachian State University's Walker College of Business enhances the academic experience by providing space and staff to assist risk management and insurance majors with networking, job placement preparation and contact with faculty members outside the classroom. It provides students opportunities to participate in professional designation and licensing programs, and invites industry leaders to participate in classes and speak to student organizations. It also fosters research and faculty development, assists the insurance industry in the design and delivery of continuing education programs and helps educate the public about the insurance industry. Appalachian is designated a Global Center of Insurance Excellence by the International Insurance Society. Learn more at https://insurance.appstate.edu.

About the Walker College of Business

The Walker College of Business at Appalachian State University delivers transformational educational experiences that prepare and inspire students to be ethical, innovative and engaged business leaders who positively impact their communities, both locally and globally. The college places emphasis on international experiences, sustainable business practices, entrepreneurial programs and real-world applications with industry. Enrolling nearly 5,000 students, including more than 4,500 undergraduates across 11 majors, the Walker College of Business has the highest full-time undergraduate enrollment in the University of North Carolina System. App State’s Walker College is accredited by AACSB International — the premier global accrediting body for business schools. Learn more at https://business.appstate.edu.

About Appalachian State University

As a premier public institution, Appalachian State University prepares students to lead purposeful lives. App State is one of 17 campuses in the University of North Carolina System, with a national reputation for innovative teaching and opening access to a high-quality, cost-effective education. The university enrolls more than 21,000 students, has a low student-to-faculty ratio and offers more than 150 undergraduate and 80 graduate majors at its Boone and Hickory campuses and through App State Online. Learn more at https://www.appstate.edu.