BOONE, N.C. — FAFSA. FSEOG. ACOG. EFC. SAP.

Exploring how to pay for a college education unearths a Scrabble set of acronyms. Fortunately, a village of interpreters are in place at Appalachian — as are a number of systems and strategies — to help students and families navigate the process and identify ways to alleviate the burden.

Appalachian Chancellor Sheri Everts often reminds constituents that while “Appalachian compares most favorably in affordability reviews, we are keenly aware that for many, the cost of a college education is burdensome — and for others, it is out of reach.”

According to the following figures, the cost of an Appalachian education does in fact compare favorably. The cost for tuition, fees, standard room and board, and most textbooks for the 2017–18 academic year:

- Appalachian’s cost is $14,645 for North Carolina residents and $29,452 for out-of-state residents.

- The national average cost, according to CollegeData, is $22,020 for state residents at public colleges and $37,676 for out-of-state residents attending public universities.

Measuring value against debt

Appalachian “is an incredible value for students and families,” said Cindy Barr, the university’s vice chancellor for enrollment management. “That is why I am committed to this work, as I do see education as a means to disrupt the cycles of poverty and to impact lives. It’s a privilege to serve at an institution that is affordable, that’s committed to access and inclusion.”

In terms of incurring debt, Barr cautioned toward good judgment.

“If you can graduate college with debt that is similar to a really nice car, that’s an investment in your future,” she said. “If your debt is more like a modest mortgage, that is probably not a wise decision. Helping students and families understand reasonable debt vs. oppressive debt, is vital.”

Barr said she encourages students and families to “consider the big picture” — not just tuition, but the total cost of attendance — and then choose the college or university where students believe they will be most successful.

Out of the 300 higher education institutions included in Kiplinger’s Personal Finance magazine’s “Best Values in Colleges” list for 2018, Appalachian ranks 29th among public colleges and 111th among all colleges.

Appalachian aids student success

Still, to graduate, a good percentage of Appalachian students and families do or will need assistance. For the 2017–18 academic year:

- 68 percent of Appalachian students received some type of aid.

- 30 percent of undergraduates were recipients of Pell Grants — debt-free money the federal government provides for eligible students to pay for college.

- 2,405 students (around 12 percent) were at or below the federal poverty guidelines.

The Office of Student Financial Aid at Appalachian falls under Barr’s direction, as do the Office of Admissions, College Access Partnerships and the Office of Transfer Services. Each of these units are primed to help students succeed.

According to Barr, it all begins with the admissions process: “A lot of what we’re doing in enrollment management is focused on admitting well-qualified students from diverse backgrounds — racially, ethnically, geographically, socio-economically. There is a lot of care and intent that goes into that selection up front to make sure we do have a diverse class who is well equipped to succeed here.

“Retention begins with admission. We have an academic responsibility to admit a class that is academically prepared to retain and graduate, shares Appalachian’s values of sustainability and inclusive excellence and is more reflective of the world our students will inhabit when they graduate. Our commitment to holistic review for admission to the university is critical to achieving these goals.”

FAFSA — file early and follow-up

For those who make the cut, the Office of Student Financial Aid is where the money is — and where students and their families can gain assistance in understanding the financial acronyms and how to navigate them. The office administers state and federal aid as well as outside scholarships.

Students who are interested in applying for private scholarships should consult Appalachian’s Office of University Scholarships for assistance in identifying merit and departmental scholarships.

Financial Aid Interim Director Adam McCourry said it is key students file FAFSA applications early. FAFSA stands for the Free Application for Federal Student Aid — the form the federal government, states, colleges and other organizations use to award financial aid.

He strongly advises students file FAFSA as early as possible after Oct. 1 — the first day the form is available — for the 2019–20 academic year. Why? “We award supplemental funds based on a student’s EFC — Expected Family Contribution. We have smaller pots of money that dry up quickly,” he said. “The student who files in October and is awarded in April will get more than the student who files in June.”

To keep students on track, McCourry said his office communicates heavily around the first of October, when FAFSA goes live.

“We typically hold a FAFSA day in our office on the last Saturday of October to help students complete the FAFSA. We also use the digital monitors in most buildings around that time to remind students to file their FAFSA. We are not currently using any social media, but it is something we may explore in the future,” he said.

The financial aid office is proactive in helping students meet deadlines and find funding sources. Each of the financial aid counselors have caseloads of around 2,000 students, McCourry said.

“We also have a counselor of the day program where students can walk in anytime — 8 a.m. to 5 p.m., Monday through Friday — and see a counselor without an appointment. Still, one of the most important things students can do is monitor their AppalNet account and appstate.edu email.”

One in three FAFSA applications is audited, he said, which requires his office to acquire tax returns and other verifications on income. In the process, an application “can get hung up,” he said.

Staying on top of applications and payments is a responsibility that ultimately falls on the student. A few days after tuition was due, Barr said she and her staff had reviewed the accounts that were outstanding.

“We had about 350 students whose schedules were cancelled because they had not paid or their financial aid papers weren’t filed,” she said. “Many of the students we contacted were not aware of their financial position.”

“There’s a balance, right?” Barr posed. A balance “between being supportive of students, wanting to preserve schedules and working to ensure they have a smooth transition,” she said, “but there’s also a lot of learning that happens outside of the classroom, in terms of accountability.”

Manage money owed

The responsibility, ultimately, is the students’, McCourry concurred. “It’s not just managing what you (students) get, but what you owe,” he said.

Appalachian’s Office of Student Financial Aid sends an alert when a student’s debt exceeds $19,000. And, McCourry said, at that point, students are encouraged to look into some financial planning assistance.

He said the office offers help with financial literacy, as does the Walker College of Business, Wellness and Prevention Services, the Office of Student Success and other academic units. “But, it’s all over the place. We aren’t reaching all the new students,” he said. “If we had a financial literacy portion of Gen Ed, that could minimize or help reduce some of the overborrowing.”

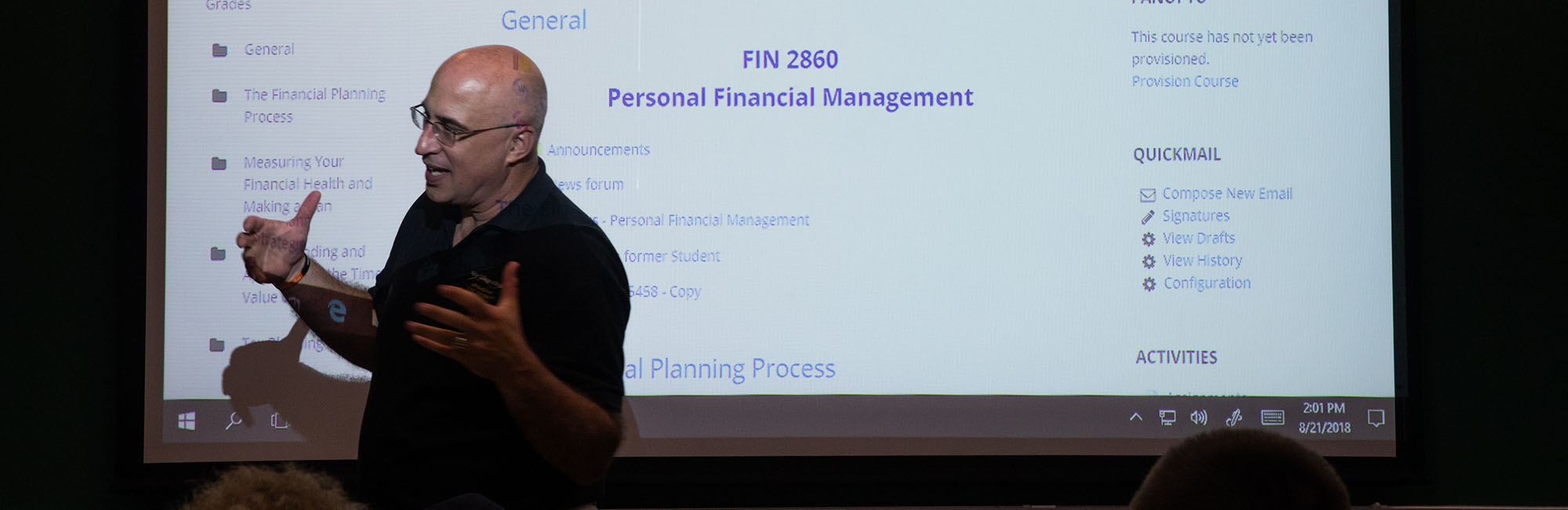

Bryan Bouboulis, senior lecturer in the Department of Finance, Banking and Insurance in the Walker College of Business, is an advocate for helping develop students’ fiscal literacy and responsibility. His Personal Finance 3030 course provides a study of the key concepts and tools that are necessary to help students manage their personal finances and avoid financial difficulties as they transition from college life to their professional careers.

The course centers on the basics, he said: how to budget; saving for financial emergencies and major purchases; investing for the future; retirement planning; selecting the appropriate investment instruments; use of insurance; and personal debt management. He wants his students to think about “the end game.”

“If you don’t know where you’re going, how will you get there?” he asked.

Bouboulis’ goal is to spread the word about his class, especially with incoming students. “I’ve made inroads with the Greeks and athletes” on Appalachian’s campus, conducting workshops specifically designed for them, he said. By fall 2019, Bouboulis said he hopes “to be in front of every incoming parent and student with the basics about his course.”

Barr said she supports the idea and is interested in exploring with others the idea of a centralized program to build financial literacy.

Transfer students face different challenges

About one-third of Appalachian’s more than 19,000 undergraduates are transfer students who benefit from a support system designed specifically for them.

Staff from Appalachian’s Office of Transfer Services work with community college students early in the enrollment process, providing them specialized advising to help them choose classes that will transfer easily and make the most of their financial resources. Once on the Appalachian campus, transfer students benefit from dedicated support services, including transfer-specific event programming, along with transfer clubs and organizations.

Some challenges transfer students encounter, according to Associate Director of Transfer Services Kim Morton:

- Many community colleges do not offer student loans, so new transfer students don’t have experience with the loan program. In addition, since these students often either receive full financial grants to cover their tuition or are paid from employment earnings at the community college level, they are hesitant to take out loans at four-year institutions.

- On-campus housing is not guaranteed for transfer students (only 25 percent of new transfer students this fall will be able to live on Appalachian’s campus), so they must secure off-campus housing. They incur the expense of long-term leases, security payments and internet and power charges — expenses those living on campus do not have to encumber. Additionally, many rental companies require a guarantor (or co-signer), and often parents don’t have the credit and/or salary history to qualify.

- Many students continue to work full time while enrolling in upper level courses, creating more challenges for academic success.

- And, because they are working, students may have to go to school part time, thus extending the time it takes to degree completion and the inherent costs.

Finding balance academically, financially, personally

Why 8 dimensions of wellness are important to students’ holistic balance

About Appalachian State University

As a premier public institution, Appalachian State University prepares students to lead purposeful lives. App State is one of 17 campuses in the University of North Carolina System, with a national reputation for innovative teaching and opening access to a high-quality, cost-effective education. The university enrolls more than 21,000 students, has a low student-to-faculty ratio and offers more than 150 undergraduate and 80 graduate majors at its Boone and Hickory campuses and through App State Online. Learn more at https://www.appstate.edu.

What do you think?

Share your feedback on this story.

![The Search for Vertical Grasslands [alumni featured]](/_images/_posts/2026/03/vertical-grasslands-600x400.jpg)

![How NCInnovation Is Rethinking Economic Development in North Carolina [faculty featured]](/_images/_posts/2026/02/rethinking-economic-development-600x400.jpg)